Movens Capital’s Investment Theses in AI

Movens Capital is a multistage-stage generalist fund that invests in the most ambitious tech startups in the CEE region, particularly those driving transformative innovations in Artificial Intelligence (AI). The explosion of AI/ML solutions, especially from CEE, offers immense promise. However, the market is increasingly saturated with companies branding themselves as “AI-driven,” making informed investment decisions more complex. To clarify our priorities, we’ve outlined our investment theses in AI below, blending opportunity with realism.

Why AI, Why Now: CEE as a Global AI Powerhouse

CEE is on track to become a global AI powerhouse due to its deep STEM talent pool (over 1 million developers) and a strong track record of AI success stories. Even before the generative AI (GenAI) boom, over 1,000 regional AI startups raised more than $4 billion. Companies like UI Path, ElevenLabs, Grammarly, Veriff, FintechOS, and Rossum are emerging as global AI leaders, benefiting from the region’s rich R&D environment supported by tech giants like Google, Intel, and Samsung. Founders from the region have played significant roles in global companies like OpenAI (Wojciech Zaremba), Snowflake (Marcin Żukowski), or DeepL (Jarek Kutylowski), showcasing the immense skill and ambition here.

However, while this growth is impressive, founders need to ensure they aren’t just riding the AI wave but building long-term defensible companies. It’s required to attract sustainable funding or deliver high-value exits.

Key Investment Theses in AI

When analyzing AI startups, we still prioritize the fundamentals: team, market, and product. However, the speed of AI innovation demands that founders demonstrate clear defensibility and scalability early on. Here are the specific factors we scrutinize:

- Unique domain knowledge and exceptional execution capabilities of the team. It’s great to combine with significant AI-related research or publications to validate expertise;

- Proprietary, hard-to-acquire data to create significant moats;

- Specific vertical focus, where competitive advantages can be built;

- A Go-To-Market strategy targeting the U.S. and Western Europe, enabling rapid growth;

- User experience as a critical success factor.

Below are some of the most promising areas where we see real potential, alongside challenges that founders must address:

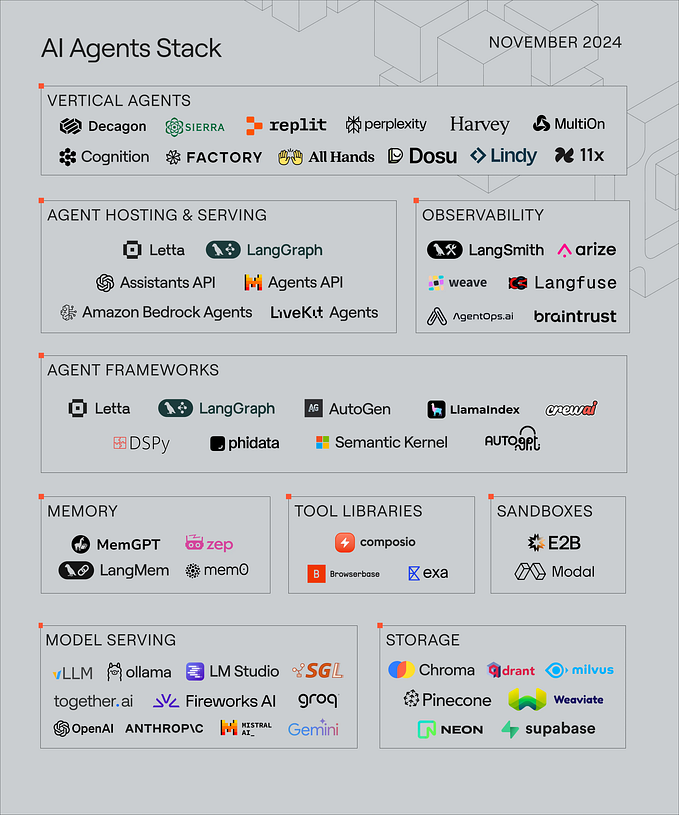

1. Tools and Infrastructure for AI/GenAI: Empowering the Ecosystem

- Thesis: AI’s long-term success hinges on robust infrastructure and tools, which ensure scalability, privacy, and workflow optimization. AI isn’t just about creating new models but empowering the ecosystem with the right infrastructure.

- Opportunity: Startups focusing on model monitoring, fine-tuning environments, and end-to-end AI development pipelines will be critical for large-scale adoption. However, this space is competitive, and we will prioritize those enhancing efficiency in niche verticals or through significant proprietary advancements.

2. Specialized Generative AI (GenAI) Applications: The Frontier of Innovation

- Thesis: GenAI’s potential to revolutionize industries such as healthcare, cybersecurity, sales and marketing, financial services, education, manufacturing, and drug discovery is compelling. However, it’s critical to focus on niche, fine-tuned models that solve specific industry problems, rather than applying generic large language models (LLMs). It’s also important to acknowledge that adoption hurdles, especially in highly regulated industries, may slow down progress and limit widespread use in the short term.

- Opportunity: Startups developing niche models using open-source tools like Llama or Mistral, while addressing latency, privacy, scalability, and regulatory concerns, offer the most potential for real-world applications. However, the success of these models depends heavily on acquiring high-quality proprietary data and navigating complex privacy and legal frameworks in sectors like healthcare and financial services. Industries such as manufacturing and education offer potential, but clear monetization models and scalable deployment strategies will be key to achieving long-term success.

3. AI-Driven Enterprise Software: Beyond Basic Automation

- Thesis: AI will drive the next wave of enterprise software optimization, with the challenge being to move beyond basic automation (RPA). We prioritize companies that address deeply entrenched inefficiencies, rather than simply automating surface-level tasks.

- Opportunity: RPA 2.0, integrating AI to transform legacy systems, holds great promise. However, many startups underestimate the complexity of implementing AI into rigid enterprise ecosystems. GenAI-powered ERPs can also take this transformation further by enabling intelligent decision-making and automating complex workflows, but success will depend on balancing innovation with scalability and seamless integration. The companies that thrive will be those who can deliver clear, measurable ROI within a reasonable time frame.

4. Democratizing Content Creation: The Next Monetization Wave

- Thesis: AI is lowering the barriers for content creation, allowing individuals to produce high-quality work with minimal effort. This opens new avenues for monetization and personalization.

- Opportunity: We are looking for platforms that enable creators to monetize AI-driven content in scalable ways. The real test here is building ecosystems that offer not only creation but seamless distribution, revenue generation, and compliance with emerging IP laws in the creator economy.

5. The Rise of Smaller Language Models: Balancing Efficiency and Performance

- Thesis: While large language models have garnered attention, smaller, fine-tuned models can often rival them in performance while being more cost-effective and privacy-conscious.

- Opportunity: Startups developing or applying smaller models with edge-device applications have a significant chance to succeed. However, the competitive landscape is growing crowded, so differentiation will rely on unique use cases, particularly in industrial or enterprise environments where data privacy and resource constraints are priorities.

6. AI-Driven Cybersecurity Solutions: Defending the Digital Frontier

- Thesis: With the rise of increasingly sophisticated cyber threats, real-time AI-driven security solutions are essential. Cybersecurity must evolve as fast as AI itself.

- Opportunity: We are interested in startups that can detect, predict, and neutralize threats in real-time, especially for enterprises and critical infrastructure. However, building trust with enterprise clients and proving robustness in high-stakes environments will be key challenges.

7. Agentic AI Workflows: A New Era of Iterative Intelligence

- Thesis: Agentic workflows, where AI systems autonomously complete tasks through iterative cycles of planning, reflection, and collaboration, are poised to redefine productivity across industries like software development, research, and logistics. These systems enable AI to not only execute tasks but continuously improve them through dynamic decision-making.

- Opportunity: Startups that can successfully leverage AI agents to automate complex, multi-step workflows stand to unlock significant efficiency gains and outperform even advanced static models. However, proving that AI agents can handle complex, high-stakes tasks with minimal human intervention remains a core challenge, particularly in sectors with strict accuracy or safety requirements.

8. AI-Enhanced User Interfaces for SaaS: Usability as a Key Differentiator

- Thesis: In SaaS, user interface often determines whether a company succeeds or fails. AI can significantly improve UI by learning from user interactions and personalizing the experience.

- Opportunity: Startups developing AI-enhanced UI tools that can dynamically adapt to user behavior and preferences are likely to capture market share in the competitive SaaS landscape. However, the risk lies in balancing automation with user autonomy — some users may resist overly dynamic UIs.

9. Solving Energy Challenges for AI Infrastructure: Sustainable Innovation

- Thesis: AI’s rising energy demands, particularly from data centers, present both a challenge and an opportunity. Sustainability will increasingly become a differentiator.

- Opportunity: Startups that can create energy-efficient solutions for data centers, such as optimizing cooling or reducing processing power consumption, will address a significant barrier to AI scalability.

10. Exploring Untapped Opportunities: Beyond the Horizon

- Thesis: AI creates endless possibilities across numerous sectors, many of which remain unexplored. The rapid evolution of AI technologies continues to uncover new markets and opportunities.

- Opportunity: Visionary founders can potentially disrupt traditional industries and invent entirely new categories with AI-driven solutions. While our list highlights key theses, we believe great founders can devise transformative products that we haven’t yet imagined. Movens Capital remains open to groundbreaking ideas in emerging areas that align with this dynamic landscape.

Why You Should Talk to Movens Capital

At Movens Capital, we’ve been investing in tech startups since 2014. Now, we back ambitious CEE founders, regardless of where they’ve chosen to domicile their companies. Our portfolio includes AI-driven startups like SKY ENGINE AI, Talkie.ai, StethoMe, Partory, or Attention Insight, as well as other fantastic fast-growing companies such as Vue Storefront/Alokai, Packhelp, Woltair, Doctor.one or Demoboost.

Three of our team members have been tech entrepreneurs, so we understand the challenges firsthand. For example, at Netsprint, we built a top-tier data science team that ranked highly in global Kaggle competitions. Our network includes advisors and limited partners from leading AI research centers at companies like NVIDIA, Google, Intel, Microsoft, or NASA.

Once Movens Fund 2 is launched, we typically invest with tickets ranging from EUR 0.2M to EUR 4M, but we’re in it for the long haul, helping companies grow and raise more funds over time. So far, our portfolio companies have raised over EUR 100M in follow-on rounds. With 6 successful exits and returns of 4.5x to 16x, we know what it takes to create lasting value, even in a rapidly changing space like AI.

If you’re a CEE founder ready to build something groundbreaking, Movens Capital is here to support you — you can submit your start-up here: https://movenscapital.com/apply/